בעולם הלא צפוי של היום, הבנת מדיניות ביטוח היא מרכזית לכולם. מדיניות זו פועלת כרשת ביטחון פיננסית. היא מגן עלינו מאובדן פתאומי שעשוי לפגוע בבריאות הפיננסית שלנו. עם תעשיית הביטוח מרוויחת מעל $1 טריליון בשנתיים, הבנת כיסויי ביטוח היא חשובה. מדריך הביטוח הזה יעזור לך להבין את סוגי המדיניות השונים. תלמד כיצד להעריך סיכונים ולבחור את הכיסוי הנכון לצרכיך.

מסקנות מרכזיות

- מדיניות ביטוח מספקת הגנה פיננסית חיונית נגד אירועים בלתי צפויים.

- הבנת סוגי ביטוח שונים היא קריטית לקבלת החלטות מושכלות.

- הערכת רכיבי המדיניות עוזרת בבחירת כיסוי מתאים.

- תעשיית הביטוח משמשת תפקיד חשוב בכלכלת ארצות הברית.

- בחירות מושכלות יכולות להפחית סיכונים בצורה יעילה.

מהן מדיניות הביטוח?

פוליסות ביטוח הן הסכמים מרכזיים שעוזרים להגן על אנשים ועל עסקים מפגיעות כלכליות בלתי צפויות. לדעת מהן פוליסות ביטוח מאפשר לאנשים לבחור את הכיסוי שלהם בצורה חכמה. כל פוליסה מפרטת תנאים מפורטים כמו טווח כיסוי, יוצאי דופן ויתרונות.

הגדרת פוליסות ביטוח

המונח הגדרת פוליסת ביטוח מתאר הסכם משפטי בין חברת ביטוח ובעל הפוליסה. הוא מפרט את האחריות של שני הצדדים, סכום הכיסוי והתשלום עבור הפרמיום. למרות שפוליסות יכולות להשתנות, המטרה העיקרית שלהן היא להפחית סיכונים ולהציע יציבות כלכלית בתקופות קשות.

סוגי פוליסות ביטוח

קיימים סוגים שונים של ביטוח שמתאימים לצרכים שונים. חשוב להבין את הסוגים הללו כדי לבחור את הפוליסה הטובה ביותר. הסוגים העיקריים כוללים:

- ביטוח חיים: מספק תמיכה למוטבים לאחר מות בעל הפוליסה.

- ביטוח בריאות: משלם על עלויות רפואיות ושירותי בריאות.

- ביטוח רכב: מציע הגנה על דברים הקשורים לבעלות ושימוש ברכב.

- ביטוח נכסים: שומר על בתים ופריטים אישיים מפני נזקים או גניבות.

| סוג ביטוח | מטרה | מאפיינים עיקריים |

|---|---|---|

| ביטוח חיים | הגנה פיננסית למוטבים | דמי ביטוח, גיבוי במקרה פטירה, ערך מזומן |

| ביטוח בריאות | מכסה הוצאות רפואיות | תשלומים עצמיים, פיגורים, מגבלות כיסוי |

| ביטוח רכב | הגנה נגד אירועים הקשורים לרכב | אחריות, התנגדות, כיסוי מקיף |

| ביטוח נכסים | מגן על רכוש אישי | כיסוי לגניבה, אש, ונזקים אחרים |

רכיבים מרכזיים של פוליסות ביטוח

חשוב לדעת מה מרכיב פוליסות ביטוח. כל חלק הוא מרכזי לקבלת ההגנה הנכונה. נבחן דמי ביטוח, השתתפות עצמית, ומגבלות פוליסה. הם עוזרים לך להבין מה נדרש מהביטוח שלך.

דמי ביטוח וכיסוי

דמי ביטוח הם מה שאתה משלם כדי לשמור על הביטוח שלך. הם משתנים בהתאם לדברים כמו גיל או בריאות. חשוב לראות כיצד דמי הביטוח משפיעים על הכיסוי שאתה מקבל. לשלם יותר בדרך כלל אומר לקבל יותר הגנה. לבחור בתוכנית הנכונה כולל להתבונן בפרטים אלה.

השתתפות עצמית ותשלומים חלקיים

השתתפות עצמית הם מה שאתה משלם לפני שהביטוח מתחיל לכסות. לפעמים, יש לך גם תשלומים חלקיים עבור שירותים מסוימים. לדעת את חלקי הפוליסה האלה מכין אותך לכל עלויות. הידע הזה חיוני.

מגבלות פוליסה ואי הכללה

מגבלות הפוליסה מגבילות את מה שהביטוח שלך משלם עבור ההפסד. לדעת אותן עוזר לך להימנע מכיסוי לא מספיק. אי הכללה הן הדברים שהפוליסה אינה מכסה. הן עשויות להשאיר אותך לא מוגן במקרים מסוימים. לדעת את שניהם עוזר להימנע מעלויות בלתי צפויות.

| רכיב | תיאור | השפעה על כיסוי |

|---|---|---|

| דמי ביטוח | דמי תשלום לשמירה על כיסוי | דמי ביטוח גבוהים בדרך כלל מביאים לכיסוי טוב יותר |

| פיקדונות | עלויות משלם עד שהכיסוי נכנס לתוקף | פיקדונות גבוהים מורידים את הדמי ביטוח אך מגבירים את העלויות האישיות |

| מגבלות ביטוח | התשלום המרבי שהביטוח יספק | מגבלות שעשויות להוביל לכיסוי לא מספיק |

| האסורים | אירועים שאינם מכוסים על ידי הפוליסה | יכולים ליצור פערים בהגנה פיננסית |

הבנת פוליסות ביטוח: הסבר על אפשרויות הכיסוי

פוליסות ביטוח מגיעות עם מגוון אפשרויות כיסוי. הן מגן על אנשים ועל עסקים מפני סיכונים שונים. היכרות עם אפשרויות אלו עוזרת לך לבחור את הפוליסה הטובה ביותר עבור צרכיך. בואו נסתכל על סוגי הכיסוי העיקריים בפוליסות ביטוח.

כיסוי אחריות

כיסוי אחריות הוא מרכזי להגנה מתביעות של אחרים. הוא מכסה עלויות לפגיעה פיזית או נזק לרכוש שנגרם על ידי המבוטח. לדוגמה, אם מישהו נפגע ברכושך, כיסוי זה עוזר לשלם את חשבונות הרפואה והעלויות המשפטיות שלהם. זה מגן על הכספים שלך מתביעות בלתי צפויות.

כיסוי רכוש

כיסוי רכוש מגן על הנכסים שלך מאיומים כמו גניבה, אש או אסונות טבע. הוא מכסה בתים, רכוש, או נכסים עסקיים. זה עוזר לך להתאושש מהפסדים בלעדי צרות כספיות רבות. היכרות עם אפשרויות כיסוי רכוש שלך מאפשרת לך לקבוע גבולות נכונים ולהוסיף תוספות להגנה מלאה.

כיסוי פציעות אישיות

ביטוח פציעות אישיות מכסה טענות מנזקים לא פיזיים כמו השחתת שם או נזק רגשי. זה חיוני עבור מקצוענים או עסקים שייתכן וייגרמו למישהו נזק לשם או למצב הרגשי שלו. הביטוח הזה מגן נגד קרבות משפטיים יקרים וטענות, ומציע שקט נפשי.

| סוג כיסוי | מאפיינים עיקריים | חשיבות |

|---|---|---|

| כיסוי אחריות | מכסה טענות לגוף פצוע או נזק לרכוש. | מגן על הפסד כספי מתוך טענות משפטיות. |

| כיסוי רכוש | מגן על נכסים פיזיים מגניבה ונזק. | מבטיח שיקום מההפסד ללא מתח כספי חמור. |

| כיסוי פציעה אישית | מגן על טענות לפציעות לא פיזיות. | מונע בעיות משפטיות יקרות הקשורות לנזק למוניטין. |

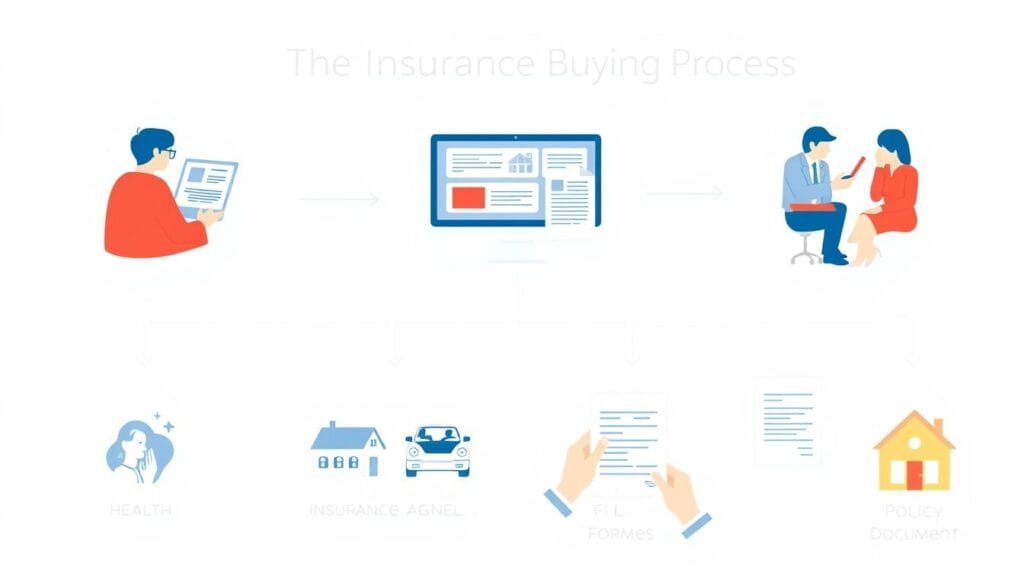

תהליך הביטוח

הבנת כיצד לקנות ביטוח היא מפתח לקבלת כיסוי המתאים. תחילה, עליך להעריך את צרכיך. לאחר מכן, עליך לאסוף הצעות מחיר ולבחון בקפידה את פרטי הפוליסה כדי לוודא שהן מתאימות. בחירה מושכלת עוזרת למנוע פרצות בכיסוי ופרמיות גבוהות.

כיצד לרכוש פוליסת ביטוח

התחל בלהבין מה באמת נחוץ לך בפוליסת ביטוח. חשוב לחשוב על אופן החיים שלך, על מה שבבעלותך, ועל החובות הפיננסיים שלך. לאחר מכן, קבל הצעות מספקים שונים להשוואה. אל תסתכל רק על המחיר. בדוק מה כל פוליסה מכסה ואת סכומי השיעור העצמי.

חשוב לקרוא את כל הטקסט הקטן. זה יכול לספק לך מידע על מה שאינו מכוסה ועל כל המגבלות. זה עוזר לך להבין את הערך האמיתי של הפוליסה.

הערכת ספקי ביטוח

בחירת חברת ביטוח הנכונה דורשת בדיקה של אמינותם ואיכות השירות שלהם. חשוב לבדוק:

- יציבות פיננסית: השתמש בדירוגים ממקומות כמו A.M. Best כדי לראות האם הם אמינים לטווח הארוך.

- ביקורות שירות לקוחות: ראה מה לקוחות נוכחיים או לקוחות בעבר אומרים ב-J.D. Power כדי לקבל תמונה אמיתית של השירות.

- יעילות בעיבוד דרישות: תהליך דרישות מהיר מראה שחברה זו דואגת ללקוחותיה.

שגיאות נפוצות בהבנת מדיניות ביטוח

הרבה אנשים מתבלבלים מהמילים המורכבות המשמשות בתחום הביטוח. הבלבול הזה מוביל לאמונות שגויות לגבי מה שהביטוח מכסה ומה לא. על ידי ניקוי הבלבול הזה, האנשים שיוצרים מדיניות והאנשים שקונים אותם יכולים להבין את הביטוח בצורה טובה יותר.

הבנת מונחים וג'רגון

מילים בתחום הביטוח עשויות להיות מבלבלות. מונחים כמו "עצירות," "הוצאות מחויבות," ו-"פרמיום" יתכן שלא יהיו מובנים על ידי כולם. לדעת מה המונחים הללו אומרים חיוני לבחירת הביטוח הנכון. לפעמים, מונחים בלתי ברורים גורמים לאנשים להאמין דברים שגויים על ביטוח.

מיתוסים נגד עובדות

רבים חושבים שביטוח בעלי בתים סטנדרטי מגן על כל סוגי הנזקים. אך, נזקים מסוימים עשויים שלא להיות מכוסים. לדעת את האמת עוזר ללקוחות לשאול שאלות טובות כאשר הם מדברים עם סוכני הביטוח שלהם.

| מיתוס | עובדה |

|---|---|

| כל נזק מכוסה על ידי ביטוח בעלי בתים סטנדרטי. | סוגים רבים של נזקים, כגון שטפון ורעידת אדמה, עשויים שלא להיות כלולים. |

| פוליסות זולות הן תמיד הטובות ביותר. | תשלומים נמוכים לעיתים קרובות אומרים פחות כיסוי או עלויות עצמיות גבוהות יותר. |

| לאחר הרכישה, הכיסוי שלך לא משתנה. | פרטי הפוליסה עשויים להתפתח, ולכן חשוב לסקור את התנאים באופן שנתי. |

כיצד לקרוא ולהבין את מדיניות הביטוח שלך

קריאת מדיניות ביטוח עשויה להראות כמשימה מאתגרת. היא נטענת בדרך כלל במונחים מורכבים ושפה טכנית. אך הבנת כיצד לקרוא את המדיניות שלך יכולה להעצים אותך באופן משמעותי. זה עוזר לך לקבל החלטות חכמות. הבנת שפת הביטוח היא מפתח לקבלת הפרטים והתנאים הנכונים.

פיענוח שפת הביטוח

רבים מבעלי הפוליסות נתקלים במילים ובביטויים מאתגרים. אלה עשויים להיות מבלבלים. הנה כמה מונחים נפוצים שתראו:

- דמי ביטוח: עלות הכיסוי ביטוח שלך.

- פריסה: מה שאתה משלם לפני שהביטוח מתחיל לכסות.

- אי הכללה: מה שהמדיניות שלך לא מכסה.

- כיסוי אחריות: זה מכסה אותך אם אתה אחראי על נזק או פגיעה.

לדעת את המונחים הללו יכול להקל עליך על קריאת והבנת הפוליסה שלך.

סקירת הפוליסה שלך באופן שנתי

כדאי לבדוק את פוליסת הביטוח שלך בכל שנה. זה מבטיח שהיא עומדת בצרכיך הנוכחיים. ייתכן שיש סיבות לשינויים, כמו:

- רכישת דברים חדשים כמו נכסים או רכבים.

- כאשר יש שינוי בגודל המשפחה שלך.

- כל נושא חדש בתחום הבריאות או התקדמויות.

בדיקות שנתיות עשויות לגלות אם יש חוסר בכיסוי במקום מסוים. לשמור על עדכון הפוליסה שלך הוא חלק מהבנת הביטוח שלך. זה אומר שאתה מוגן תמיד בדרך הטובה ביותר לחיים שלך כרגע.

מסקנה

הבנת הביטוח היא מרכזית לבחירות פיננסיות חכמות. זה חיוני מאחר שהביטוח פועל כרשת ביטחון למקרים בלתי צפויים. אנשים ועסקים יכולים לבחור את הכיסוי הנכון לצרכיהם על ידי בדיקה מקיפה של אפשרויות שונות. זה עוזר להם להישאר בטוחים מפני סיכונים אפשריים.

חשוב לדעת על דמי ביטוח, סכומי השירות ומגבלות הפוליסה. הידע הזה מאפשר לאנשים לנהל את הביטוח שלהם בצורה יותר טובה. גם ניקוי הרעיונות הלא נכונים על ביטוח עוזר. זה עושה את זה קל יותר לאנשים לנהל את הכספים שלהם בצורה חכמה. בדיקת הביטוח שלך באופן קבוע היא חובה.

למידת ביטוח עוזרת לך להרגיש בטוח בבחירת המדיניות הנכונה. הידע מאפשר לך להגן על הכסף שלך ולהתמודד עם סיכונים בצורה יותר טובה. על ידי התמקדות בהבנה, תוכל לאבטח את העתיד הפיננסי שלך בביטחון.